The November election isn’t just about the president

Learn about the other items on your ballot this year

Election Day is in less than a week! Maybe you’ve already voted early like millions of other Americans, or maybe you still haven’t gotten around to it. Voting is a big deal, after all. You need to carefully consider each item on the ballot. Even if you won’t be old enough to vote this year, it’s still a good idea to know what’s going on in your country.

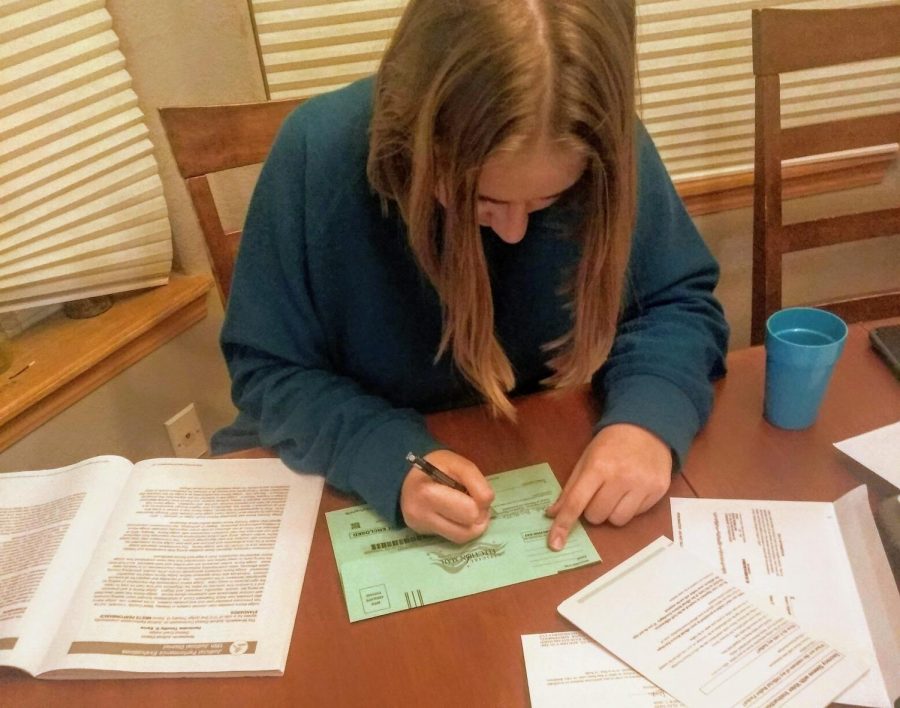

It’s really important to remember that the election isn’t just about the president. You also need to vote for various local and state officials and a ton of propositions. These are suggested changes to state laws that may or may not affect your own community, but every voter in the state gets a say with them. Propositions are often very confusing, but you should have received a 2020 State Ballot Information Booklet, which I just call the blue book. Every quote in this article is from the blue book. This booklet breaks down each proposition for you, but if you read through it and are still confused… have no fear, The Mav is here! Read on for a short and sweet summary of each proposition on the Colorado 2020 ballot for an extra simplified version of your blue book.

Amendment B would repeal the Gallagher Amendment of 1982, which “requires that residential and nonresidential property make up constant portions of total statewide taxable property over time”, according to the blue book. That means under the Gallagher Amendment, when the state taxes people’s property, a certain fraction of those taxes needs to come from residential property and a certain fraction from nonresidential property regardless of what fraction of the property in Colorado is residential or nonresidential. Right now, because of the Gallagher Amendment’s almost 40 year old requirements, 45 percent of property taxes come from residential property and 55 percent from nonresidential property even though residential property values have grown faster than nonresidential property values. In very simple terms: back in 1982, Alex (representing residential property) had 15 cookies, and Sam (representing nonresidential property) had 30 cookies. The state of Colorado wanted some cookies, too, so it took five from Alex and ten from Sam in order to take one third of each person’s cookies. Every year, this was repeated, and Colorado kept taking five from Alex and ten from Sam. However, each year, Alex got more and more cookies while Sam still had 30. Now, in the present day, Alex has a whopping 60 cookies to Sam’s 30, but Colorado still takes the same amount of cookies from each that it did in 1982 when Alex only had 15. So now, Colorado takes only one twelfth of Alex’s cookies but a whole third of Sam’s cookies, which isn’t very fair to Sam. It’s more complicated than that, and you should read your blue book if you want all of the little details.

What will change because of Amendment B? Residential property taxpayers likely will over time have to pay more taxes. Most nonresidential property taxpayers won’t have to pay more taxes. There will be more tax revenue over time for state-funded services like fire protection, education, and hospitals.

Those for this amendment think it will shift the tax burden so that it is more equitable, especially to small businesses. and provide more state funding. Those against it want homeowners to save money in this time of economic difficulty and think local governments can find other ways to fund the aforementioned services.

Amendment C would lower the time required number of years a nonprofit must operate in Colorado to qualify for a bingo-raffle license from five to three and let the legislature be in charge of any future changes of this requirement. It will also ease restrictions on bingo-raffle workers by not requiring them to be members of the nonprofit and permitting them to either be volunteers or receive a little compensation. Have you ever been to a fundraiser where you can buy raffle tickets to support a cause and maybe win a nice apple pie? That’s what this amendment is referencing. These activities count as gambling, which is mostly illegal in Colorado, but currently, a nonprofit that has been operating continuously in Colorado for five years can apply for a bingo-raffle license. With the changes proposed by this amendment, state revenue will increase by $5000 each year from more license fees, but it will also increase state spending by $83,000 next year and $37,500 in future years because of license processing changes and related investigations.

Those for Amendment C think that easing restrictions will help charitable organizations raise more funds, but those against it think it will turn bingo-raffle activities into for-profit gambling, especially by not requiring workers to be volunteers.

Amendment 76 would change the language in the Colorado Constitution concerning the citizenship qualifications of voters. According to the blue book, it will “specify that ‘only a citizen’ of the United States rather than ‘every citizen’ of the United States is eligible to vote in Colorado Elections”. Though these are only a few words, they can have a big impact on future expansions of voting rights and current state laws. The federal law is that only citizens of the age of 18 can vote, but in Colorado, 17-year-olds who will be 18 by the national election can vote in the primaries. If Amendment 76 passes, this will no longer be true because the word “only” prevents those who are not adult citizens from voting. It is yet unclear whether an individual city or town will be able to make their own rules that differ from the Colorado Constitution should Amendment 76 pass, like if Longmont wanted to lower the voting age for their citizens to 16.

Those in favor of Amendment 76 think it will keep voting rights in the hands of only U.S. citizens, while those against it think it “seeks to solve a problem that doesn’t exist” and will only result in the confusion and disenfranchisement of voters.

Amendment 77 would let local voters in Black Hawk, Central City, and Cripple Creek decide bet limits and approve new casino games in their respective cities and use casino tax revenue to fund community colleges. Currently, the Colorado Constitution has set the limit at $100 and made other small restrictions. Fiscally, Amendment 76 will increase state and local revenue but also likely increase taxes paid by casinos and increase government spending slightly as the changes in policy are made and additional elections held in the affected cities.

Those for this amendment believe it will allow voters in the affected cities to make the best decisions for their own communities and provide more opportunities to community college students during this economic downturn. Those against it think it will increase problem gambling, which is all-around bad for communities, and negatively affect nearby communities that will not receive additional tax revenue but still be close enough to the aforementioned cities to feel the negative impacts of gambling.

Proposition EE would increase taxes on cigarettes and other tobacco products and introduce a new tax on nicotine products like vapes, using the revenue to help preschool programs and public education in general. Currently, cigarettes are taxed at 84¢ per pack, and this new law would raise that tax by $1.80 by 2027 and also tax other tobacco products at 22 percent and nicotine products at 62 percent. The biggest impact of the increased tax revenues from this change would be on preschool availability. Currently, only kids from low-income families and kids needing language development get free preschool, but with the funds from Proposition EE, all kids will get ten hours per week of free preschool right before kindergarten.

This is one reason cited by supporters of this proposition in addition to the hope that it will get people to stop using the affected products. Those against it think that people who are seriously addicted to tobacco and nicotine products will continue to buy them no matter how much they cost and only experience more financial difficulty. They also think the taxes will hurt businesses that sell low-cost products and won’t actually be a dependable source of money for the preschool program: “A tax intended to decrease consumption is not a funding source on which the state should rely.”

Proposition 113 would “enter Colorado into an agreement among states to elect the President of the United States by a national popular vote once enough states join the national Popular Vote Interstate Compact”, according to the blue book. In other words, it will in effect abolish the electoral college, which you’ve probably learned about in some government class. But if you need a refresher, the electoral college is a system that gives each state a certain number of votes (the sum of their congressional representatives in both houses), and if most of the votes in a certain state go to one candidate, all of that state’s electoral votes go to the candidate. So if presidential candidate Sally Johnson is voted for by 54 percent of Coloradoans, she gets all of Colorado’s nine votes, not 54 percent of them. Instead of totalling individual votes to determine the winner, whichever candidate has over 270 electoral votes wins the election. Back in 2016, Hillary Clinton won the popular vote, meaning over half of American voters chose her, but Donald Trump won the electoral vote and therefore the presidency because he got 304 electoral votes to Clinton’s 227. Proposition 113 would end this system and have the president elected by popular vote if passed in enough states. If this were the case in 2016, Clinton would be the president (though it can’t be said who would benefit from either option in the future). Proposition 113 was put on the ballot by a petition. The electoral college cannot be truly abolished unless the constitution is amended, but this proposition would make the electors of Colorado and any other state that passes a similar proposition vote for whomever wins the popular vote regardless of who wins in their own state, effectively erasing the influence of the electoral college.

Those for the proposition argue that a popular vote ensures that every single person’s vote is worth the same and would encourage candidates to campaign in every state, not just those with the most electoral votes. They also worry that an election like that of 2016 will happen again, and the electoral vote will not reflect the popular vote. Those against the proposition worry instead that if it passes, candidates will only focus on huge population centers with the most individual votes and ignore rural communities, and they think it will undermine the Constitution.

Proposition 114 is one you’ve probably heard of through YouTube ads. It would reintroduce and manage gray wolves in Colorado through the Colorado Parks and Wildlife Commission. There would be required “statewide hearings about scientific, economic, and social considerations” along with public input to keep the plan up-to-date. Compensation would be given to any farmers who lost livestock to new wolves in their area, and additional state funds would be used to help them avoid confrontations with wolves entirely. This issue is on the ballot because gray wolves’ territory has greatly decreased throughout American history. They once lived in every state except Hawaii and those in the South. Now, they only really live in the northern Rocky Mountains and the Great Lakes region. Wolves, which are listed as endangered in every mainland state except Minnesota, are protected under the federal government by the Endangered Species Act, so individual states can’t help them unless given permission, which is what this proposition would do for Colorado. Idaho, Montana, and Wyoming already control their own wolf populations, and the wolves there have been doing pretty well with limited effects on elk, deer, and farmers.

Those in favor of this proposition argue that wolves are important for Colorado’s environment, as they keep elk and deer from overgrazing sensitive habitats, and that it will restore Colorado’s wolf population while considering Colorado’s interests. Those against it argue that wolves will hurt livestock and deer and endanger people living nearby. They also say that wolves are already making a comeback in Colorado on their own, and letting nature do its thing will give Coloradans more time to adjust.

Proposition 115 would prohibit abortions after 22 weeks (that’s about five months, near the end of the second trimester), and if someone does perform an illegal abortion, they will be criminally penalized and lose their medical license for at least three years. However, an abortion at any time will still be legal if it is needed to save the the life of the pregnant mother (this is required by the U.S. Supreme Court for all states). Currently, abortion is legal in Colorado at any point in a pregnancy, but the state does have the power to change that. This is a hotly debated issue, so I won’t say much more.

Those for this proposition argue that it protects human life in a reasonable way that doesn’t penalize the women who get abortions. Those against it argue that the decision to abort should be solely up to the pregnant woman and that this law does not have exceptions for rape, incest, nonfatal health problems, or fetal abnormalities that might “force women to carry a nonviable pregnancy to term”.

Proposition 116 would lower the state income tax rate from 4.63 percent to 4.55 percent. An income tax is a certain percent of your salary that goes to the government. (This isn’t ALL of the taxes Colorado residents need to pay; there’s also the federal income tax.) So if you make $68,000 a year, which is around Colorado’s median salary, you’ll get an extra $54.40 a year, though Colorado will lose $154 million in state revenue in year 2021-2022.

Those for this proposition argue that it will give individuals more money to help them in this financially difficult time and that the state budget is doing fine and can handle the cut. Those against it say that the budget cut will cause layoffs and reduce state services but only really benefit the super rich that don’t need the extra money.

Proposition 117 would require voter approval for new state enterprises. State enterprises are government-owned businesses (ie. Parks and Wildlife) that get most of their funding from fees (ie. hunting/fishing licenses). Under current TABOR limitations, the state can do whatever it wants with the money it gets as long as the amount earned falls beneath a certain limit that adjusts every year, but if it gets more than that limit, the extra money goes back to the taxpayers. Enterprises, however, are not subject to TABOR limitations and therefore get to keep all the money they earn, though unlike some other government businesses, they don’t get very much money from state tax revenue. Being an enterprise is like being a kid going off to college: you have to make your own money and live on your own, but you can do whatever you want with your money and your life. If an enterprise is no longer termed an enterprise, it has to follow the TABOR limitations and will receive more state funding. That would be like a successful young lawyer going back to live with their parents: you make good money and get a bunch of support from your parents, but you have to follow your parents’ rules and give them some of your paycheck. By requiring voter approval of state enterprises “that are expected to collect fee revenue of over $100 million during the first five fiscal years”, Proposition 117 would probably reduce the amount of government-owned businesses that are listed as enterprises. Some existing enterprises that made over $100 million in their first five years would be affected and have to depend more on state funding and less on their own fees than they did before.

Those for this proposition argue that it allows citizens to better control the size of their government and the fees they have to pay for government services. Those against it argue that the current system makes it so the people actually using a service are the ones paying for it, not all taxpayers together.

Proposition 118, last but not least, would “create a paid family and medical leave insurance program for Colorado employees”. This program would give employees up to 12 weeks of paid family and medical leave and keep them from getting fired for taking that paid leave. Every employer and employee would have to pay into this program, and probably not every employee would directly benefit since not all employees have needy families and/or health problems, but this program would provide a kind of safety net for all Colorado employees in case they do have a family or health problem come up. Covered absences include maternal and paternal leave, taking care of yourself or someone else with severe health issues, “safe leave for domestic or sexual abuse”, and helping a military family member that needs to leave. The program would cost 0.9 percent of an employee’s wage, half paid by the employer and half by the employee. So if we again assume you make the median Colorado wage of $68,000, you pay $306 a year to this program. However, if you have a personal or family emergency, you could gain a lot more than that from this program.

Those for this proposition argue that it will greatly benefit families, especially new developing children that need bonding time, and benefit the state economy by increasing employment opportunities. Those against it argue that it will place a big financial and paperwork load on businesses and keep smaller businesses from growing and that some employees will be paying for a program they will never use.

We hope that this clears up those confusing propositions. Remember that election day is on Nov. 3. It is probably too late to mail your ballot in time, but you can still turn it in to a ballot box or go vote in person at a polling center. Please complete your civic duty of voting with seriousness and sincerity.

Your donation will support the student journalists of Mead High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Adah McMillan is a Senior. She enjoys reading, drawing, eating candy, playing the piano, listening to musicals, and being right. She is involved in choir, NHS, the MHS Book Club, and SVVSD's Innovation Center. She is excited to do more work in The Mav this year and make the website as perfect as it can be.

You can contact her at mcmill.adah22@svvsd.org.

Kassidy Trembath • Feb 25, 2021 at 3:42 pm

This is such a good article! So proud to see such great work.